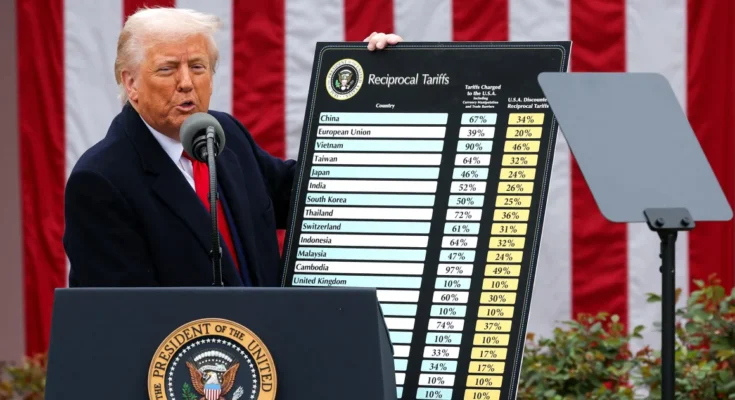

Despite shaken financial markets, threats of retaliation, and even pressure from some of President Donald Trump’s staunchest supporters to scale back his signature economic policy, he remained firm. On Wednesday, his administration imposed a slew of new “reciprocal” tariffs on dozens of both American allies and adversaries, aiming—according to Trump—to restore fairness and boost U.S. manufacturing.

Goods from China, the largest target, are now facing a minimum tariff of 104%. Trump added even higher tariffs than originally planned after Beijing refused to back down from its pledge to impose 34% retaliatory tariffs on U.S. goods on Tuesday.

The so-called reciprocal tariffs, which aren’t truly reciprocal, were determined by calculating a country’s trade deficit with the U.S. and dividing that by its exports to America, then multiplying the result by half. The new rates range from 11% to a staggering 50%. With the exceptions of Mexico and Canada, America’s top trading partners didn’t escape this round. The EU faces a 20% tariff, China 34%, Japan 24%, Vietnam 46%, and South Korea 25%.

These new tariffs come just days after Trump imposed a 10% universal tariff on imports from all countries, except Mexico and Canada. (For countries already on the reciprocal tariff list, the 10% rate is not additive. For example, Japan’s tariff rate increased by 14% on Wednesday due to the 10% tariff imposed earlier in the week.)

“Our country and its taxpayers have been ripped off for more than 50 years. But it won’t happen anymore,” Trump said last week when announcing the tariffs, which are the highest the nation has seen in over a century.

Just hours before the tariff took effect on Tuesday, Trump reiterated his stance, adding that other countries, especially China, have “left us for dead, frankly.”

Now, Americans and people worldwide are poised to bear the brunt of the cost. Importers—rather than the targeted countries—will be responsible for paying the tariffs, and those costs often trickle down to wholesalers, retailers, and ultimately consumers. However, businesses abroad won’t escape unscathed, as American companies may look to source goods from countries with lower tariff rates.

Ultimately, Trump’s tariffs could ignite a global trade war. On Wednesday, China’s Foreign Ministry vowed to take “resolute and effective measures” to protect its rights and interests, though it stopped short of announcing immediate retaliatory actions.

Recession and stagflation fears mount

With trillions of dollars in market value wiped out since “Liberation Day” on April 2, concerns about a global recession have grown.

JPMorgan has raised the likelihood of a global recession to 60% by year’s end, up from 40%, if Trump moves forward with his full plan.

“The tariff hikes since the beginning of the Trump administration now amount to the largest U.S. tax increase in nearly 60 years,” JPMorgan economists wrote in a note last week. “This would have direct implications for household and business spending, as well as ripple effects through retaliation, a decline in business sentiment, and supply chain disruptions.”

The nonpartisan Tax Foundation estimates that American consumers will pay at least $2,100 more annually due to the tariffs.

Since returning to the White House, Trump has been busy. Prior to last week, he had already announced a 20% tariff on all Chinese imports and 25% tariffs on steel, aluminum, and car imports.

Earlier this week, Goldman Sachs raised its forecast for a U.S. recession within the next 12 months to 45%, marking a 10-percentage-point increase from previous projections. In a note titled “Countdown to a Recession,” the bank’s economists stated that they “had expected the White House to announce a more aggressive tariff initially and then scale it back somewhat.”

Unless the tariffs are significantly revised, Brian Bethune, an economics professor at Boston College, predicts that the U.S. economy will slip into a recession by the second quarter of this year. Even more concerning, Bethune warns that these tariffs could trigger stagflation—when economic growth sharply declines while inflation rises.

“The probability of stagflation is 100%,” he told CNN, noting that inflation from Trump’s tariffs will begin impacting consumer prices by May, with an acceleration expected in June and July.

However, not everyone shares this view. Morgan Stanley analysts argued on Tuesday that the U.S. would avoid recession, believing Trump would ultimately negotiate deals with other countries to lower tariffs. Additionally, Trump’s chief trade advisor, Peter Navarro, appeared on Fox News Monday evening, confidently asserting that he guaranteed the U.S. economy would not fall into recession.

Despite numerous countries offering to negotiate, it remains uncertain whether any deals will be reached quickly—or at all. Trump and his administration have emphasized that they view non-tariff trade barriers, such as currency manipulation, unfair tax policies, and exploitative labor practices, as more significant than tariffs. This stance has led them to reject various offers from countries proposing to set tariffs on U.S. goods at 0% in exchange for reciprocal treatment.

Hitting the World’s Second-Largest Economy

Trump’s tariffs have hit China hardest, leading to a full-blown trade war between the two largest global economies. When Trump’s first term ended, the U.S. imposed an average tariff rate of 19.3% on Chinese goods, according to an analysis by the Peterson Institute for International Economics. The Biden administration maintained most of Trump’s tariffs while adding others, increasing the average rate to 20.8%.

For decades, both China and the U.S. have benefited from trade. But since Trump’s first term, the U.S. has sought alternatives to Chinese imports, with Mexico emerging as a top beneficiary. In 2023, Mexico overtook China as America’s largest source of imports—a position it retained into 2024. Other Asian nations, including Vietnam, South Korea, and Taiwan, have also seen increased trade flows to the U.S. since Trump’s first term.

Despite these shifts, the 104% tariff on Chinese goods remains a significant factor and could increase even further. China was still the second-largest source of foreign goods to the U.S. in 2024, according to U.S. Commerce Department data, exporting $439 billion worth of goods to the U.S. while the U.S. sent $144 billion to China. China also remains the top foreign source for several items.

These mutual tariffs threaten to harm domestic industries and could lead to job losses.

If Trump were to cancel his tariffs, which he has repeatedly vowed not to do, much of the economic damage could be reversed, but not entirely. Colin Grabow, associate director at the Cato Institute’s Herbert A. Stiefel Center for Trade Policy Studies, told CNN, “Trump’s actions have significantly hurt U.S. credibility, not only through the tariff’s flimsy justifications but also the violation of long-standing free trade agreements with U.S. trading partners. Businesses need a certain degree of certainty in which to operate, and Trump’s chaotic approach is not providing that.”