US President Donald Trump’s ongoing trade war with China has dealt a significant blow to US stock markets.

Amid rising tensions between Trump and Chinese President Xi Jinping, new US export restrictions to China are expected to cost consumers billions. The 78-year-old Republican has imposed stricter limits on a policy introduced by his predecessor, President Joe Biden, which restricts American computer chip companies from selling certain products to businesses in China.

The goal is to hinder the communist nation’s efforts to advance artificial intelligence for both military and commercial purposes.

Nvidia, one of the US’ leading chipmakers, saw its stocks drop by as much as 10 percent on April 16, before recovering slightly to a 6.87 percent decline.

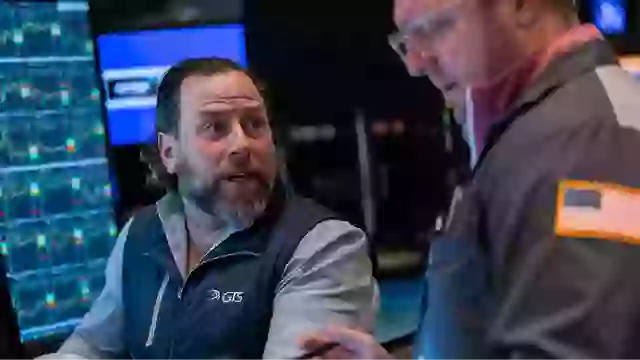

Trader Peter Michael Tuchman reacts as he works on the floor of the New York Stock Exchange at the closing bell (TIMOTHY A. CLARY/AFP via Getty Images)

This came after the US government had already banned the sale of Nvidia’s most powerful computing chip, the H100 AI chip, to China.

As a result, Nvidia will now need a license from Washington, D.C., to sell its H20 chips to China.

On Tuesday, the tech company projected that this decision would result in a $5.5 billion loss.

Meanwhile, rival chipmaker AMD also saw its stock plummet by 7.35 percent, with the Trump administration also requiring the company to obtain a license to sell its most powerful chip.

This comes just days after China announced it would increase tariffs on the US, raising them from an additional 84 percent to a staggering 125 percent.

President Donald Trump has placed up to 245 percent tariff on Chinese imports (Win McNamee/Getty Images)

On Tuesday, Trump signed an executive order “launching an investigation into the national security risks posed by the US reliance on imported processed critical minerals and their derivative products.”

The order specified, “China now faces up to a 245% tariff on imports to the United States due to its retaliatory actions.”

Despite the sharp decline in the US stock market yesterday, the inflation rate in the US actually fell to 2.4 percent last month, the lowest since September, down from 2.8 percent in February.

When it comes to starting a trade war, there may be some method behind Trump’s approach. His administration is aiming for a level playing field, as many countries impose higher taxes on US imports than they do on goods from other nations.

Trump believes the pressure from tariffs will eventually lead to reduced trade barriers on US products and encourage more domestic production, boosting the American economy.

However, while the US remains optimistic, it must first prepare for retaliatory tariffs, with the costs ultimately passed onto consumers in the country.