President Donald Trump announced sweeping tariffs on the United States’ largest trading partners Wednesday, vowing to undertake the most significant restructuring of the global economy since World War II.

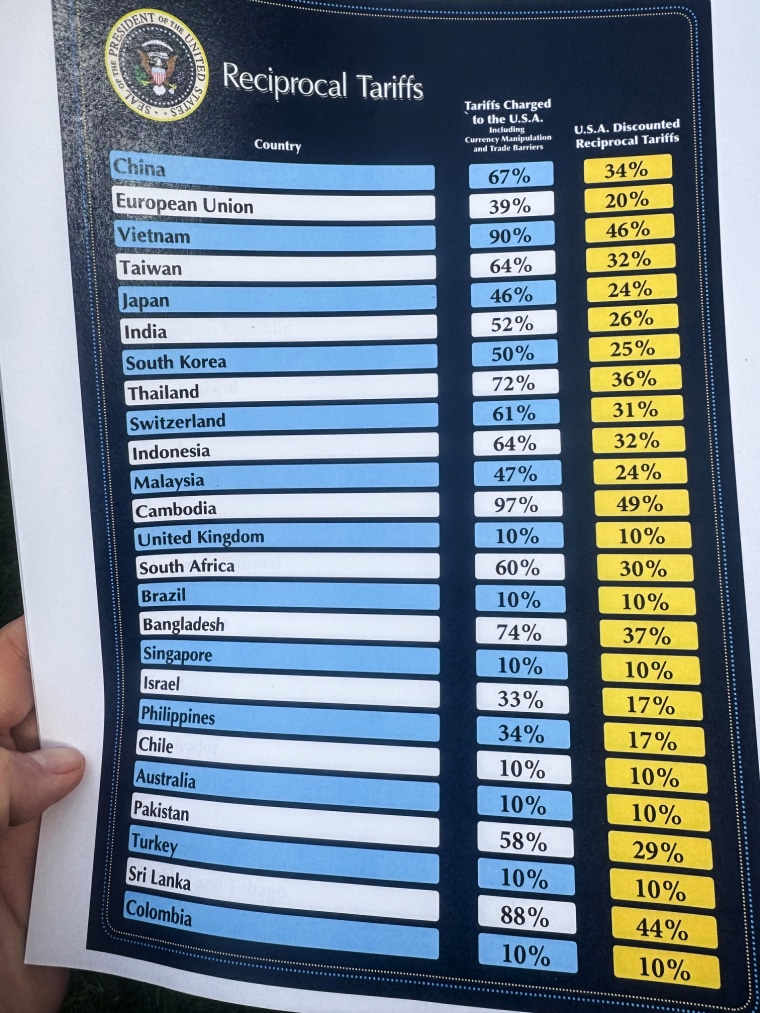

Imports into the U.S. will now face tariffs as high as 54%, based on the White House’s calculations of duties on American exports and additional “nonmonetary” trade barriers, including currency manipulation and environmental policies.

The new tariffs target billions—potentially trillions—of dollars in trade. China will face a 54% tariff, the European Union 20%, India 26%, and Japan 24%, among others.

The methodology behind these figures remained unclear, with a White House handout stating the calculations accounted for “currency manipulation and trade barriers.”

U.S. stock markets reacted sharply, reversing earlier gains as Trump delivered his remarks. S&P 500 futures dropped 1.5% in after-hours trading.

Speaking from the White House Rose Garden, Trump criticized what he described as “much higher” tariffs on American exports compared to U.S. import duties.

“America has been looted, pillaged, raped, and plundered,” Trump declared, promising that American industry “will be reborn” and heralding a new “golden age of America.”

The announcement aims to overhaul long-standing trade agreements that have led the U.S. to outsource labor-intensive manufacturing in exchange for lower consumer prices—at the expense, critics argue, of the nation’s industrial base.

Trump contended that instead of benefiting, the U.S. has been “ripped off” by other countries while working-class wages have stagnated. Speaking to reporters before the Rose Garden event, White House officials asserted that the global trade institutions in place “no longer fit the times.”

However, rather than delivering an immediate boost to the U.S. economy, the tariffs are expected to strain businesses that depend on global supply chains, potentially forcing price increases or cutting into profit margins. Acknowledging potential short-term hardships, the White House has urged patience, framing the tariffs as a necessary step toward long-term economic gains.

How the American public will react remains uncertain, particularly given Trump’s earlier promises to stabilize or even lower prices after an inflation-heavy recovery under President Joe Biden following the pandemic’s economic turmoil.

Although Trump was elected in part due to his perceived ability to boost the economy, he also campaigned heavily on imposing tariffs. Now, that commitment appears to be taking priority—leaving economists, business leaders, and even many of his own voters surprised.

“When confronted with the argument that Trump was serious about tariffs, putting them on everything, the response was, ‘It’ll be the same as in 2016: He didn’t do it,’” said Michael Strain, director of economic policy studies at the pro-business American Enterprise Institute, speaking to NBC News ahead of Wednesday’s announcement.

Instead, Strain noted, “What we’ve seen over the last two months is pretty light on traditional GOP policies and heavy on MAGA. Business leaders have been quite confused and disappointed with what’s happened so far.”

The rollout of Trump’s sweeping tariffs has been anything but smooth, with last-minute changes and reversals. Just a day before Wednesday’s announcement, White House press secretary Karoline Leavitt admitted that Trump and his team were still “perfecting” the policy.

As the new trade measures loomed, countries scrambled to adjust. Vietnam and Israel signaled they would ease tariffs on U.S. goods, while European leaders continued to push for negotiations.

But even before implementation, the mere threat of these tariffs has fueled economic uncertainty. Stock markets have tumbled, while business and consumer confidence has taken a hit. The Federal Reserve has already revised its inflation forecasts higher for this year and next, expecting companies to pass on increased costs to consumers—raising prices on everything from avocados to lumber, cellphones, and cars.

Although Fed Chair Jerome Powell suggested the inflationary impact could be “transitory,” recent surveys indicate consumers believe price increases may accelerate. The University of Michigan’s latest consumer confidence report found long-term inflation expectations surged to a 32-year high, marking the largest three-month jump on record. Meanwhile, two-thirds of respondents expect unemployment to rise—the highest share since 2009.

“This trend reveals a key vulnerability for consumers, given that strong labor markets and incomes have been the primary source of strength supporting consumer spending in recent years,” the report stated.

Businesses are already feeling the pressure. In a survey published by the Dallas Federal Reserve last month, an oil and gas industry executive said tariff threats “immediately increased the cost of our casing and tubing by 25%.” The same executive warned that the administration’s goal of pushing oil prices down to $50 a barrel had forced their firm to slash capital expenditures for 2025 and 2026.

“‘Drill, baby, drill’ does not work with $50-per-barrel oil,” the executive said.

Trump has offered multiple justifications for the tariffs, from revitalizing American manufacturing to increasing government revenue and curbing the flow of fentanyl and undocumented migrants. But at its core, the policy aligns with his long-standing obsession with America’s trade deficit. He has repeatedly accused other nations of “ripping us off” and taking unfair advantage of the U.S.

Even before Wednesday’s announcement, Trump was already claiming victory, insisting that private companies had committed to more U.S. investments in two months than during Biden’s entire presidency. While some firms have announced increased domestic spending, analysts remain skeptical about whether these commitments stem from Trump’s trade threats or were already planned.

Economists argue that Trump’s view of global trade is outdated. While inflation-adjusted median earnings stagnated for decades—especially for men, whose median wages have been flat for 45 years—earnings have steadily risen for both men and women over the past decade. And despite its large trade deficit, the U.S. remains a global manufacturing leader, with exports reaching record values even after adjusting for inflation.

Nonetheless, Trump’s administration appears committed to its nationalist economic agenda, regardless of the broader consequences.

“The average wage in the services sector is higher than in manufacturing,” said Michael Strain, director of economic policy studies at the American Enterprise Institute. “We should not want to reallocate a whole lot of workers from higher-paying into lower-paying jobs out of some misplaced nostalgia for some imagined past. We should not wish for American workers to be sewing tennis shoes together—they can have better jobs than that.”