Bybit, one of the leading cryptocurrency exchanges, has fallen victim to a massive hack, with $1.5 billion in digital assets stolen. This breach is now being regarded as the largest crypto heist ever recorded.

The attackers targeted Bybit’s cold wallet, a secure offline storage system intended to safeguard funds. The stolen assets, mostly in ether, were swiftly moved across multiple wallets and liquidated through various platforms.

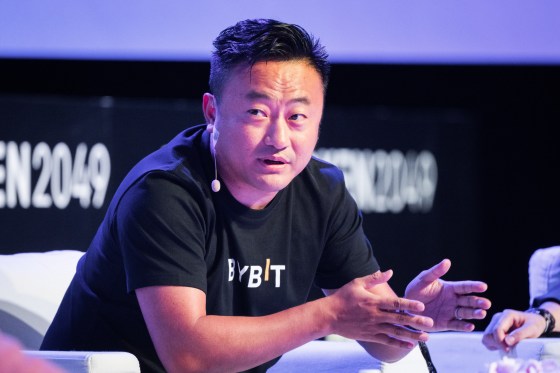

In response to the breach, Bybit CEO Ben Zhou took to X to reassure users, stating, “Please rest assured that all other cold wallets are secure. All withdrawals are NORMAL.”

Blockchain analysis firms such as Elliptic and Arkham Intelligence tracked the stolen cryptocurrency as it was transferred across multiple accounts and quickly liquidated. According to Elliptic, this hack significantly exceeds previous thefts in the crypto sector, including the $611 million stolen from Poly Network in 2021 and the $570 million taken from Binance in 2022.

Elliptic analysts later attributed the attack to North Korea’s Lazarus Group, a state-sponsored hacking collective infamous for stealing billions from the cryptocurrency industry. The group is known for exploiting security weaknesses to fund North Korea’s regime, often employing advanced laundering techniques to obscure the movement of funds.

“We’ve labeled the thief’s addresses in our software to help prevent these funds from being cashed out through other exchanges,” said Tom Robinson, chief scientist at Elliptic, in an email.

The hack sparked a wave of withdrawals from Bybit as users worried about the exchange’s potential insolvency. CEO Ben Zhou stated that outflows had since stabilized. In an effort to reassure customers, Zhou revealed that Bybit had secured a bridge loan from undisclosed partners to cover any unrecoverable losses and ensure the platform’s continued operations.

The Lazarus Group has a long history of targeting cryptocurrency platforms, dating back to 2017 when the group breached four South Korean exchanges and stole $200 million worth of bitcoin. As law enforcement and crypto tracking firms work to trace the stolen funds, industry experts caution that large-scale thefts remain a significant and ongoing risk in the crypto space.